Most Economists Believe That the Best Monetary Policy Target Is

Monetary policy capacity matters too. Economists are not in agreement as to which one is the best target variable.

Ohhh Okay Now Econ 2000 Makes Sense Economics Humor Economics Lessons Economics Quotes

Four most important objectives of monetary policy are the following.

. While the experience after the Great Recession will inform this transition the economy is in a very different place so the transition. Adverse shocks such as an oil price increase can lead to higher unemployment and higher inflation. And the bank has repeatedly said that our expectation is that we still have if we need to do it scope of further reductions in the.

The Reserve Bank tries to influence the output. Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing borrowing by banks from each other to meet their short-term needs or the money supply often as an attempt to reduce inflation or the interest rate to ensure price stability and general trust of the value and stability of the nations currency. 97 of our experts correctly predicted the RBA would hold the cash rate at its meeting on 05 April 2022.

Stabilising the Business Cycle. This autonomy will be in certain ways similar to that of the central bank where monetary policy is conducted by professional central bankers and economists without the interference of. However monetary policy can stimulate or dampen demand.

Such benchmarks typically emanate from technical work undertaken by IMF staff although it does not necessarily follow that these benchmarks are officially endorsed by. In the Keynesian view aggregate demand does not necessarily equal the productive. Monetarism gained prominence in the 1970sbringing down inflation in the United States and United Kingdomand greatly influenced the US.

Is there an optimal debt-to-GDP ratio. Central banks decision to stimulate the economy during the global recession of 200709 Today monetarism is mainly. Keynesian economics ˈ k eɪ n z i ə n KAYN-zee-ən.

Many governments have given responsibility for monetary policyoften described as inflation targetingto central banks. Sometimes Keynesianism named after British economist John Maynard Keynes are the various macroeconomic theories and models of how aggregate demand total spending in the economy strongly influences economic output and inflation. Before his successful 1992 US presidential campaign Bill Clintons.

Monetary policy cant affect the economys capacity to supply. Monetary policy affects aggregate demand and inflation through a variety of channels. RBI Monetary Policy Highlights.

Monetarists believe that the objectives of monetary policy are best met by targeting the growth rate of the money supply. And potentially the world. This is done by adjusting short-term interest rates.

The official cash rate remains at the historic low of 010. Economists of the Monetarist school adhere to the virtues of monetary policy. Consider bank credit as a better target variable.

In the jargon of economists the difference between demand and the economys capacity to supply is known as the output gap. It is less clear that there is fiscal capacity today in some other countries. Monetary policy should be systematic not automatic.

In summary I believe the case for transitioning monetary policy away from emergency levels of accommodation and recalibrating policy to todays economic challenges in pursuit of our dual-mandate goals is very compelling. Reserve Bank of Indias bi-monthly Monetary Policy Committee MPC votes to keep repo rate and reverse repo rates unchanged at. Anis Chowdhury and Iyanatul Islam1 In current debates on fiscal consolidation proposed prudential limits on public debt-to-GDP ratios play a crucial role.

The simplicity of the Taylor rule disguises the complexity of the underlying judgments that FOMC members must continually make if they are. I On the basis of the criteria of measurability and attainability both money supply and bank credit are better target variables than interest rates. So the main one is policy capacity matters both monetary and fiscal.

Fiscal space is really important and we still have that in Australia today. Most economists believe that the Federal Reserves quantitative easing program helped to rescue the US. When a nations economy slides into a recession these same policy tools can be operated in reverse constituting a.

1 Stabilization Policy Chapter Introduction How Should The Government Policy Makers Respond To Business Cycles Some Economists Argue That The Economy Ppt Download

Economic Functions Of Government Ssef5 The Student Will Describe The Roles Of Government In A Market Economy A Explain Why Government Provides Public Ppt Download

1 Stabilization Policy Chapter Introduction How Should The Government Policy Makers Respond To Business Cycles Some Economists Argue That The Economy Ppt Download

Inflation Friend Or Foe World Finance

32 Debates In Macroeconomics Monetarism New Classical Theory And Supply Side Economics Chapter Outline Keynesian Economics Monetarism The Velocity Ppt Download

Monetary Policy And The Debate About Macro Policy Ppt Download

1 Stabilization Policy Chapter Introduction How Should The Government Policy Makers Respond To Business Cycles Some Economists Argue That The Economy Ppt Download

Short Run Economic Fluctuations Ppt Download

Why Is Inflation So Low Econofact

Solved 1 Describe The Determinants Of Money Demand And Chegg Com

Aggregate Demand And Aggregate Supply Ppt Download

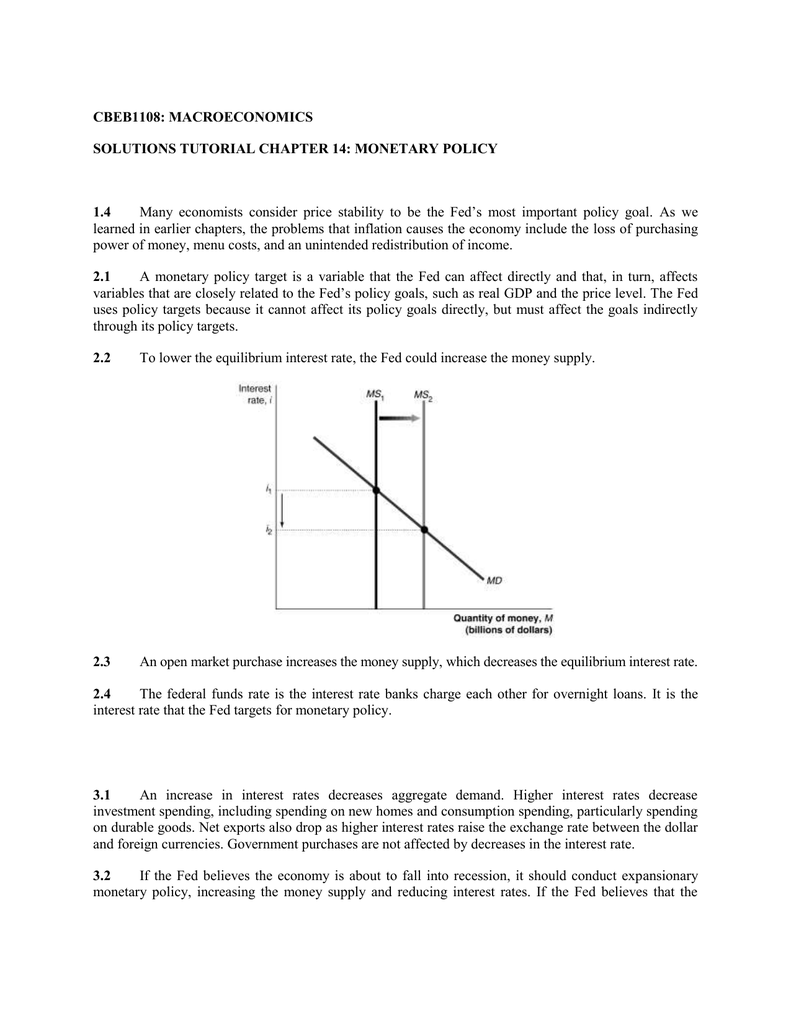

Cbeb1108 Macroeconomics Solutions Tutorial

The New Powell Doctrine The Economist

The New Powell Doctrine The Economist

Outlook Inflation Naysayers Versus The Comeback Kid Asset Class Reports Ipe

Monetary Policy And The Debate About Monetary Policy Ppt Download

Solved Table 29 4 Bank Of Cheerton Assets Liabilities Chegg Com

Comments

Post a Comment